The EB-5 Immigrant Investor Program is a U.S. visa program offering a pathway to permanent residency (a green card) for foreign investors who make significant investments in U.S. businesses, leading to job creation. Established in 1990 by the U.S. Congress, the program aims to stimulate the economy through capital investment and job creation.

Recently, the EB-5 program underwent an upgrade with the U.S. Congress passing the EB-5 Reform and Integrity Act of 2022. This has made the program more responsive to immigrants and safer for investors. EB-5 has been popular in many countries, and the new reforms further enhance its appeal.

Requirements

To qualify for the EB-5 visa, foreign investors must meet specific criteria:

- Investment amount: The new legislation offers opportunities for investors in rural areas, with a minimum investment amount of $800,000 compared to the new standard minimum of $1,050,000. Rural investments can also provide priority processing and set-aside visas.

- Job creation: The investment must create or preserve at least ten full-time jobs for U.S. workers within two years of the investor’s admission to the U.S. as a Conditional Permanent Resident. In some cases, the job creation requirement can be satisfied indirectly through investments in regional centers, which pool EB-5 investments and allocate them to job-creating projects.

- At-risk capital: The investor’s capital must be at risk, meaning that there is a possibility of financial loss.

- Management: The investor must be involved in the management of the new commercial enterprise, either through day-to-day managerial control or through policy formulation.

If the investor meets these requirements and their application is approved, they and their immediate family members (spouse and unmarried children under 21) are granted Conditional Permanent Resident status for a two-year period. After two years, if the investor can demonstrate that they have met the program’s requirements, the conditions will be removed, and they will become a Lawful Permanent Resident.

Priority Processing

The Reform and Integrity Act calls for investors who apply through projects in rural areas to have their application processed as a priority over investors who apply through projects located within an MSA. The new law also states that the goal is to get priority qualifying I-526 (conditional green card) petitions adjudicated within 120 days for projects in rural areas and 240 days for nonpriority projects in MSAs.

It’s essential to take these processing times with a grain of salt, as the targets stated in the new law differ significantly from the current times stated by the agency responsible for processing EB-5 applications, the United States Citizenship and Immigration Services (USCIS). The USCIS’s average for 2022 was 47.5 months. However, there is reason to hope I-526 processing times for typical non-rural projects will eventually fall back to their historical average of about two years. Therefore, it would be reasonable to assume that a priority processing case could take about one year since the stated delta between what is in the law and what is in the USCIS website are both close to a 1-to-2 ratio (120 days vs. 240 days and 29 months vs. 62 months, respectively).

Each year, the U.S. government allots 10,000 U.S. immigrant visas to be issued through the EB-5 program. This is not many visas when you consider that, on average, each investor is bringing two to three family members with them. So, what happens when the USCIS issues all of the EB-5 visas for any given year? The simple answer is that a backlog is created and investors with an EB-5 visa approval have to wait until the next year to receive their visa at the consulate.

To ensure that investors from all countries can benefit from the program and prevent one or two countries from using up all the visas in any given year, the number of EB-5 visas allocated to each country is capped at 7% of the available visas per year. This cap has been advantageous for investors from countries other than India and China. The current USCIS bulletin shows backlogs for China and India with priority dates of 3/22/15 and 11/8/19, respectively. Only investors with approvals before those dates are eligible to have their green cards issued. All other countries are marked as “C” or current, meaning they can schedule an appointment to have their green cards issued as soon as their initial petitions are approved.

The Reform and Integrity Act reduces delays for backlogged countries by setting aside 20% of all EB-5 visas for new investors in rural areas. This allows investors from India and China to bypass the queue if they invest in projects offering set-aside visas, such as those in rural areas.

It is worth noting that a backlog could eventually occur for rural area petitions, so investors from India and China should act quickly. For those with potential projects in rural areas, it would be wise to focus fundraising efforts on investors from these specific countries, as they are likely to benefit the most. Of course, this does not mean that investors from other countries would not be interested.

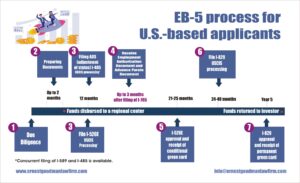

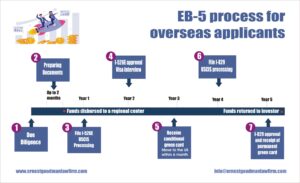

The EB-5 visa process, a key pathway for investors seeking U.S. residency, differs based on the applicant’s current location, be it inside or outside the United States.

For overseas applicants, the process encompasses several steps:

- Due Diligence: Potential investors should start with comprehensive due diligence on EB-5 projects and regional centers. This is crucial, given the multi-year duration of the EB-5 process. Our firm employs open-source intelligence for thorough analysis, ensuring investors make well-informed decisions.Leading our team, Attorney Ernest Goodman, with his cybersecurity background, enhances our due diligence capabilities, providing an added layer of depth and security in our evaluations. We recommend investors also consult with specialized legal and financial experts in the EB-5 program. With our expertise, investors can confidently navigate the complexities of their EB-5 investment.

- Preparation of Legal Documents: Engaging a U.S.-licensed immigration attorney is crucial for properly documenting the legal source of your investment funds. We have extensive experience in guiding clients through this process, ensuring that funds from sources such as professional income, property sales, or inheritance are thoroughly and legally documented.

- Project Selection, Investment and Filing Petition I-526E: Selecting the right project is vital. The USCIS scrutinizes the business plan to ensure compliance with immigration laws. The investment requirement is $800K for projects in Targeted Employment Areas (TEAs) and $1 million and 50 thousand for non-TEAs. After investing, the regional center provides a receipt, and your attorney files for a conditional green card. The approval process for the I-526E form typically spans 18-24 months.

- Consulate Interview Preparation and Process: Upon approval, the case moves to the National Visa Center. Within 6-8 months, an interview is scheduled, where various aspects of your investment and the project’s progress are reviewed.

- Receiving Entry Visa and Activating Conditional Green Card: Successful interviewees receive an immigrant visa stamp, allowing them to enter the U.S. and activate their conditional green card.

- Filing Form I-829 for Condition Removal: About 21-24 months post-receipt of the conditional green card, an application to remove conditions is filed. It’s important to demonstrate the investment’s deployment and job creation impact.

- Capital Repayment and Unconditional Green Card Receipt: EB-5 investors can expect capital repayment after two years, post-conditional green card receipt. The unconditional green card is typically issued within 30-36 months.

For U.S.-based applicants, the process includes:

We offer comprehensive services from the beginning of the process to its conclusion. We can establish a business entity, negotiate agreements, draft contracts, and handle the entire immigration process.