Film Financing & Minimum Guarantee (MG) Agreements

Hello everyone,

On October 6th, 2025 at 04:00 pm, I’ll be speaking on a panel at the Film Festival at Hollywood Park about film financing and distribution deals. One of the most misunderstood yet crucial deal types for indie filmmakers today is the Minimum Guarantee (MG) Agreement.

MGs can bring confidence to your investors, allow your project to move forward, and provide proof that distributors see value in your film. But if misunderstood or poorly negotiated, they can drain the value of your project and leave producers wondering why their “big sale” never put money back into their pockets.

Let’s unpack what MGs are, how they function, and what they mean specifically for romantic comedies with budgets in the $2M–$2.5M range that feature recognizable stars.

I decided to explore romantic comedies because it is my favorite genre. I am currently working on a romcom titled The Man in a Case. The project allows me to combine my passion for storytelling with the universal appeal of romance and humor, and I believe this genre creates a strong connection with audiences worldwide.

🔑 What is a Minimum Guarantee (MG)?

A Minimum Guarantee is essentially a promise of payment from a distributor to a producer, regardless of how the film performs commercially. It is an advance against expected revenue.

– How it works: A distributor commits to paying a fixed sum (e.g., $1M for U.S. rights). The producer receives some portion upfront and the remainder upon delivery. The distributor then markets and exploits the film, keeping revenue until they’ve recouped their MG plus marketing expenses.

– For producers: The MG provides security and cash flow. Even if the film underperforms, that guaranteed sum is money in hand. It’s often the difference between finishing post-production or leaving a film incomplete.

– For distributors: The MG is a calculated risk. They’re essentially betting that their marketing, audience reach, and distribution strategy will allow them to earn more than the MG they paid.

Think of an MG as the bridge between production costs and the market: it’s not profit, but it’s validation.

⚖️ Key Legal Elements of MG Agreements

1. Recoupment Mechanics

The distributor recoups their MG before the producer sees a dollar in backend revenues.

– Example: If the distributor pays a $500,000 MG and the film earns $800,000, the first $500,000 goes back to them. The remaining $300,000 may be split between distributor and producer per the contract (often 50/50 or 70/30 in favor of distributor).

– Risk for producers: If the film doesn’t exceed the MG, producers may never see “overages.” In fact, most indie producers only ever see the MG.

2. Territory & Rights Definition

MGs are almost always tied to specific territories and formats:

– A distributor may pay $750K for U.S. and Canada theatrical + streaming rights, while another pays $500K for UK rights.

– Problems arise when producers don’t clearly define what’s being sold. If you license “all media worldwide” to one distributor for too low an MG, you lose the ability to sell international rights separately.

Careful drafting prevents overlaps and ensures you can maximize territory-by-territory sales.

3. Delivery Requirements

Distributors usually attach strict delivery clauses before they’re obligated to pay the MG balance. These often include:

– Master files (often in multiple formats)

– Music cue sheets & synchronization licenses

– Chain of title documents proving clear IP ownership

– Errors & Omissions (E&O) insurance

– Subtitles, closed captions, dubbed tracks for international

If you miss even one, the distributor can withhold final payment. Delivery costs can easily reach $50K–$150K, so producers must budget for this.

4. MG vs. Pre-Sale Agreements

MGs are often confused with pre-sales:

– Pre-sale: Distributor commits to buying rights based on projected performance, but payment is usually conditional (e.g., “we’ll pay once the film is delivered and accepted”). Pre-sales help raise bank loans during production.

– MG: A true advance, payable regardless of performance. It’s money upfront against revenue, but with strict recoupment.

The difference is crucial. Pre-sales are about financing; MGs are about distribution security.

5. Risks for Producers

While MGs can be exciting, they also pose risks:

– Locked rights: If a distributor pays $1M for “worldwide all rights” but underperforms, your film is stuck.

– Recoupment hurdles: With marketing deductions and expenses, your backend might never materialize.

– Loss of long-term upside: A low MG deal may close quickly, but you might lose out on a much bigger opportunity later.

📊 Can a $2M Film Be Sold for $4M–$6M?

Absolutely — but only under the right conditions. Sale prices are not tied directly to budget. A $2M film can sell for $500K … or $6M. It depends on:

– Cast value (bankability of star actors)

– Genre and market demand

– Festival response (buzz, reviews, awards)

– Sales agent leverage

– Timing (market cycles, streamer appetite)

Benchmark Ranges

– Modest MGs: $300K–$800K (per territory, typical for mid-level stars).

– Strong buzz + star cast: $800K–$1.5M per major territory (e.g., North America).

– Global packages/streaming acquisitions: $3M–$6M+ total, especially if multiple buyers compete.

– Breakout hits: $8M–$10M+ (rare, usually with festivals like Sundance).

🎬 Romcoms with Stars ($2M–$2.5M Budgets)

Romantic comedies have a unique appeal in today’s market:

– Why streamers like them: They’re evergreen, feel-good, and rewatchable — perfect for subscriber retention.

– Why theatrical distributors hesitate: Unless there’s an A-list lead, romcoms are harder to justify on big screens.

Expected Sales Outcomes for $2M–$2.5M Romcoms with Stars

| Scenario | Likely Sale Value | Notes |

|---|---|---|

| Mid-level stars (recognizable TV or secondary film actors) | $1.5M–$3M | Covers much of budget, but not guaranteed full recoupment |

| Bankable romcom stars (actors known for comedy/romance) | $3M–$5M | Real chance to exceed budget |

| Festival breakout (Sundance, Toronto, Tribeca) | $5M–$8M | Bidding wars possible |

| Streamer acquisition (exclusive global rights) | $4M–$6M+ | Platforms sometimes overpay for exclusive romcoms |

Real-World Comparisons

– The Big Sick (budget ~$5M) → sold to Amazon for $12M.

– Palm Springs (budget ~$5M) → sold to Hulu/Neon for $17.5M.

– Set It Up (Netflix romcom) → acquired outright, reportedly above budget.

These examples show how the right star power and market positioning can multiply budget in the sale price.

💵 Numerical Waterfall Example – The Hidden Math

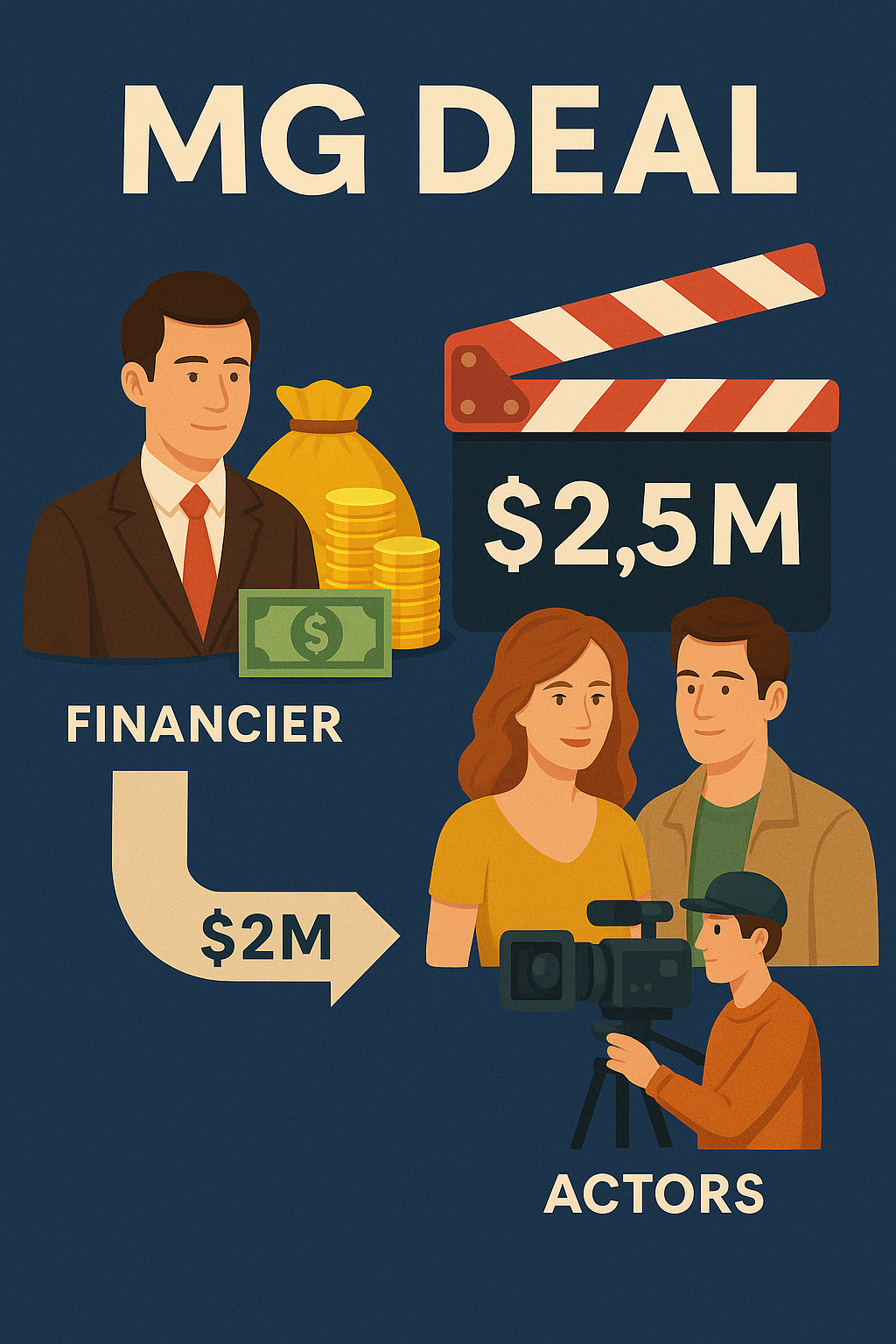

Let’s say you have a $2M romcom and secure $2.5M in MGs/pre-sales:

– Gross deals announced: $2.5M

– Sales agent fee (20%): –$500K → $2M left

– Delivery/marketing costs: –$300K → $1.7M left

– Producer recoups against $2M budget: Still $300K short, despite “$2.5M in sales.”

👉 Lesson: Headline sales figures ≠ producer profit. Fees and costs reduce the actual amount recouped.

✅ Takeaways for Filmmakers

– MGs are essential tools: They provide cash flow, investor confidence, and proof of market value.

– Contracts matter more than headlines: A $2.5M deal can leave you in the red if commissions and costs aren’t capped.

– Romcoms are well-positioned: A $2M–$2.5M romcom with stars can realistically sell for $3M–$6M, with upside if it lands a streamer or festival breakout.

– Plan conservatively, hope for upside: Budget as if MGs will cover 70–80% of costs. Treat upside sales or bidding wars as a bonus, not a guarantee.

👉 I’ll be unpacking these issues in much more detail during my panel at the Film Festival at Hollywood Park. If you’re attending, join us to discuss how to structure MGs, protect your rights, and position your romcom for the strongest possible sale.

As an an Entertainment snd IP attorney, my mission is to help creative professionals protect their rights, secure financing, and build sustainable careers in this rapidly evolving industry.

✍️ Written by Ernest Goodman, Entertainment & IP Lawyer.

⚠️ Disclaimer by Ernest Goodman, Esq.

This article is intended for informational purposes only and does not constitute legal advice. Reading or relying on this content does not establish an attorney-client relationship. Because laws differ by jurisdiction and continue to evolve, readers are encouraged to consult a qualified attorney licensed in the relevant jurisdiction for advice tailored to specific circumstances.

.