Two Paths to Obtaining an EB-5 Investor Visa

Dear Friends,

I attended the EB-5 Conference in Newport Beach on January 15-16, 2024. It was an exceptional event, offering a unique opportunity to meet and network with regional center representatives, agents, and fellow investors. The experience was enriching, and I had the pleasure of meeting a multitude of professionals in the field.

I am also excited to announce that I will be participating in the upcoming EB-5 Conference in Dubai, UAE, on October 17th. This event promises to be another fantastic opportunity for deepening connections within the industry and gaining further insights into the world of EB-5 investments.

Today, we’re going to discuss two pathways to obtaining an EB-5 visa in the U.S. The first way is tailored for investors residing outside the United States, allowing them to invest in American enterprises and gain a path to U.S. residency. The second way caters to investors who are already living in the U.S., providing them with the opportunity to adjust their status to permanent residency through investment.

The EB-5 visa program, created by Congress in 1990, encourages foreign investment in the U.S. economy. It offers a method for eligible Immigrant Investors to become lawful permanent residents—informally known as ‘green card’ holders—by investing at least $1 million in a new commercial enterprise that creates or preserves at least 10 full-time jobs for qualifying U.S. workers. A reduced investment amount of $800,000 applies if the investment is made in a rural area or high-unemployment area known as a Targeted Employment Area (TEA).

Watch our video about EB-5 visa process in YouTube.

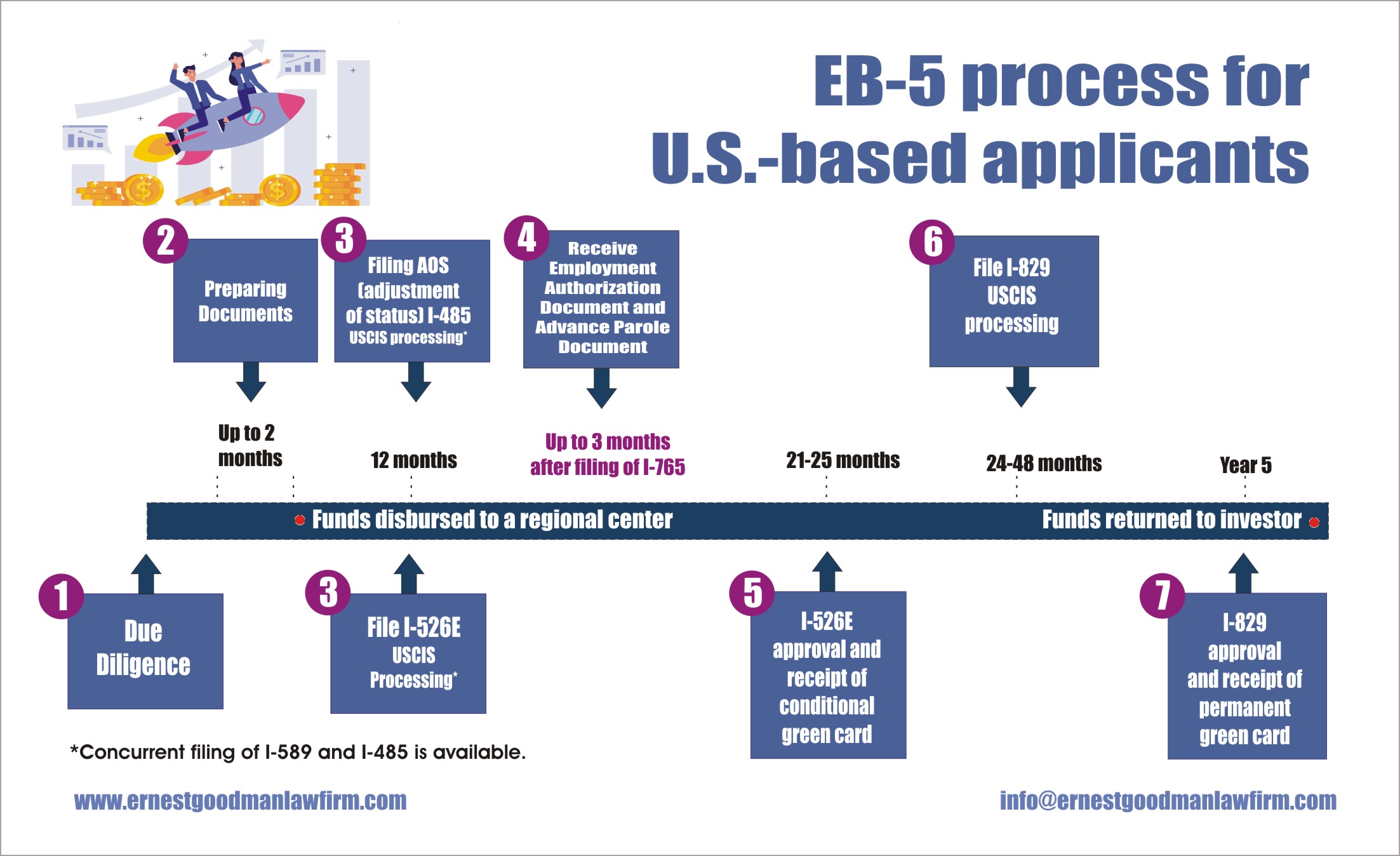

The process is quite meticulous, requiring detailed documentation of the source of funds, a well-structured business plan, and evidence of job creation. Despite the complexity and investment required, the EB-5 program remains popular due to its direct route to U.S. citizenship for investors and their immediate families, following a period of conditional residency.

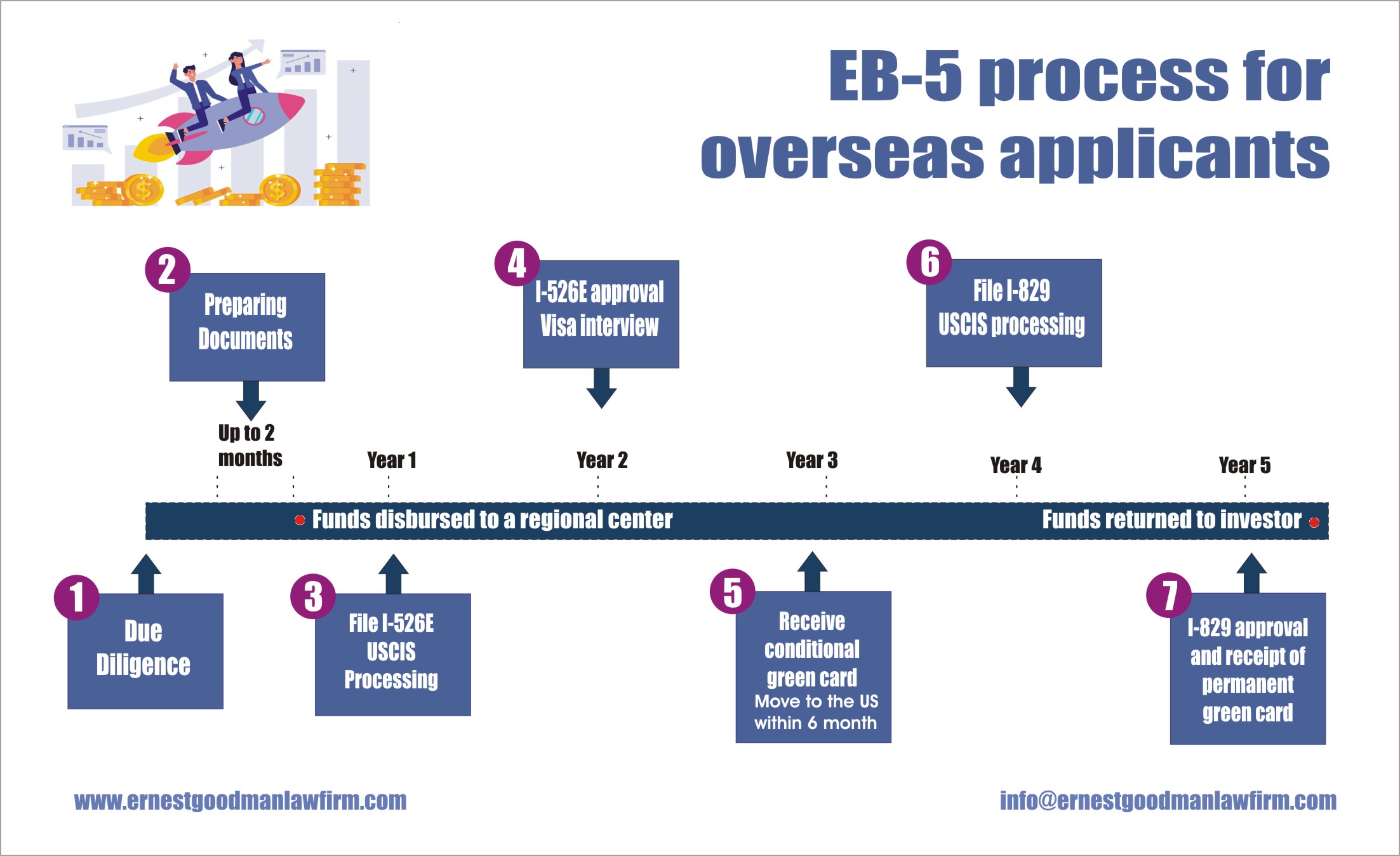

For overseas applicants, the process encompasses several steps:

- Due Diligence: Potential investors should start with comprehensive due diligence on EB-5 projects and regional centers. This is crucial, given the multi-year duration of the EB-5 process. Our firm employs open-source intelligence for thorough analysis, ensuring investors make well-informed decisions.Leading our team, Attorney Ernest Goodman, with his cybersecurity background, enhances our due diligence capabilities, providing an added layer of depth and security in our evaluations. We recommend investors also consult with specialized legal and financial experts in the EB-5 program. With our expertise, investors can confidently navigate the complexities of their EB-5 investment.

- Preparation of Legal Documents: Engaging a U.S.-licensed immigration attorney is crucial for properly documenting the legal source of your investment funds. We have extensive experience in guiding clients through this process, ensuring that funds from sources such as professional income, property sales, or inheritance are thoroughly and legally documented.

- Project Selection, Investment and Filing Petition I-526E: Selecting the right project is vital. The USCIS scrutinizes the business plan to ensure compliance with immigration laws. The investment requirement is $800K for projects in Targeted Employment Areas (TEAs) and $1 million and 50 thousand for non-TEAs. After investing, the regional center provides a receipt, and your attorney files for a conditional green card. The approval process for the I-526E form typically spans 18-24 months.

- Consulate Interview Preparation and Process: Upon approval, the case moves to the National Visa Center. Within 6-8 months, an interview is scheduled, where various aspects of your investment and the project’s progress are reviewed.

- Receiving Entry Visa and Activating Conditional Green Card: Successful interviewees receive an immigrant visa stamp, allowing them to enter the U.S. and activate their conditional green card.

- Filing Form I-829 for Condition Removal: About 21-24 months post-receipt of the conditional green card, an application to remove conditions is filed. It’s important to demonstrate the investment’s deployment and job creation impact.

- Capital Repayment and Unconditional Green Card Receipt: EB-5 investors can expect capital repayment after two years, post-conditional green card receipt. The unconditional green card is typically issued within 30-36 months.

For U.S.-based applicants, the process includes:

We offer comprehensive services from the beginning of the process to its conclusion. We can establish a business entity, negotiate agreements, draft contracts, and handle the entire immigration process.